In the ever-evolving world of cryptocurrencies, innovation is key to staying ahead. Evolve Foundation, with its unique blend of blockchain technology backed by a reserve of physical gold, brings a breath of fresh air with its deflationary model. This blog post explores the implications and potential impact of Evolve’s deflationary approach on the broader crypto market.

Understanding Deflationary Models

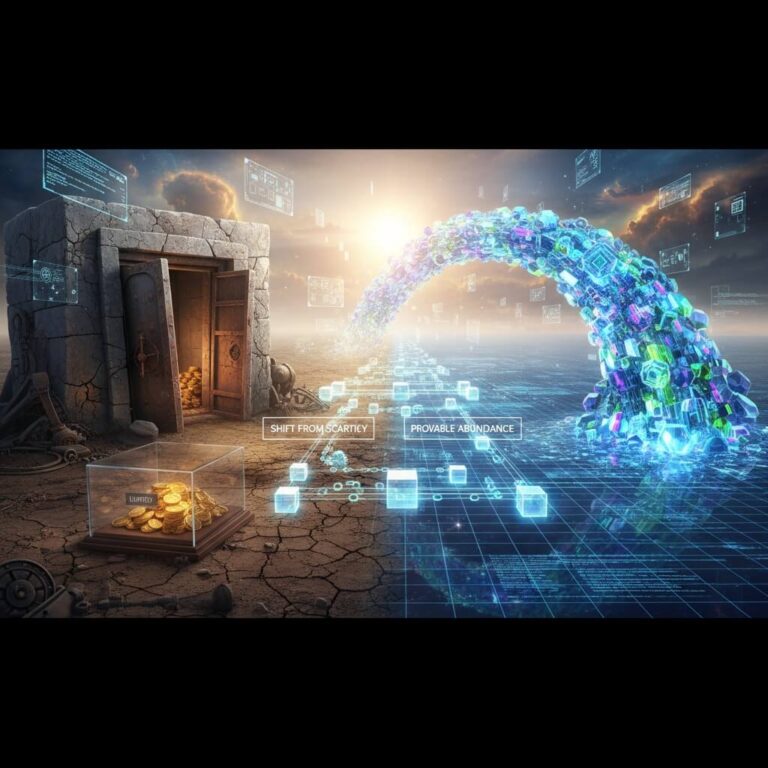

A deflationary model in cryptocurrency refers to a system where the total supply of the token decreases over time. This is in stark contrast to inflationary models where the supply increases. The primary benefit of a deflationary model is the potential increase in token value as the supply diminishes, assuming constant or increasing demand.

Evolve’s Deflationary Dynamics

Evolve takes the deflationary model to the next level by integrating it into its unique ecosystem, known as Evo nomics. Here’s how it works:

- Transaction Fee Allocation: Every transaction on the Evolve blockchain incurs a fee, which is split among nodes/stakers, holders, the foundation, and certified projects. A portion of these fees is also burned, reducing the total supply of EVO tokens.

- Physical Gold reserve: The deflationary nature of EVO tokens is further bolstered by the backing of physical gold reserves. This adds an intrinsic value to the tokens, making them a tangible asset.

- Hybrid Proof of Stake Consensus: Evolve uses a hybrid proof of stake consensus, which is more energy-efficient compared to traditional proof of work systems. This ensures that the deflationary model is sustainable in the long run.

Implications for the Crypto Market

- Increased Token Value: As the supply of EVO tokens decreases, the value of each token is likely to increase, assuming demand remains steady or grows. This can make EVO tokens attractive for both short-term traders and long-term holders.

- Enhanced Security and Trust: The physical gold backing and bi-monthly audits add a layer of security and trust that is often lacking in other cryptocurrencies. This can attract more conservative investors who are wary of the volatility and lack of transparency in the crypto market.

- Economic Sustainability: The hybrid proof of stake consensus ensures that the deflationary model is not only economically sustainable but also environmentally friendly. This aligns with the growing demand for green and sustainable technologies in the crypto space.

- Incentivizing Participation: By splitting transaction fees among various holders and burning a portion, Evolve incentivizes active participation in its ecosystem. This can lead to increased adoption and usage of the Evolve blockchain.

Real-World Applications and Future Prospects

Evolve’s integration of blockchain technology with physical assets opens up numerous real-world applications. From transparent voting mechanisms to humanitarian efforts, the potential uses are vast. The upcoming milestones, including wallet development, Evo swap, and bridges, further enhance the utility and accessibility of the Evolve ecosystem.

The “Million Wallets” campaign, aimed at onboarding a million users through airdropping 1 EVO coin to new Evolve wallet creators, is a testament to Evolve’s commitment to widespread adoption. With partnerships like United Freedom Fund and CDDA, the future looks promising for Evolve and its innovative deflationary model.

Conclusion

Evolve Foundation’s deflationary model is set to revolutionize the crypto market. By combining blockchain technology with a reserve of physical gold backing, Evolve offers a unique and sustainable investment opportunity. As the crypto market continues to mature, models like Evolve’s could pave the way for a more secure, transparent, and economically viable future.